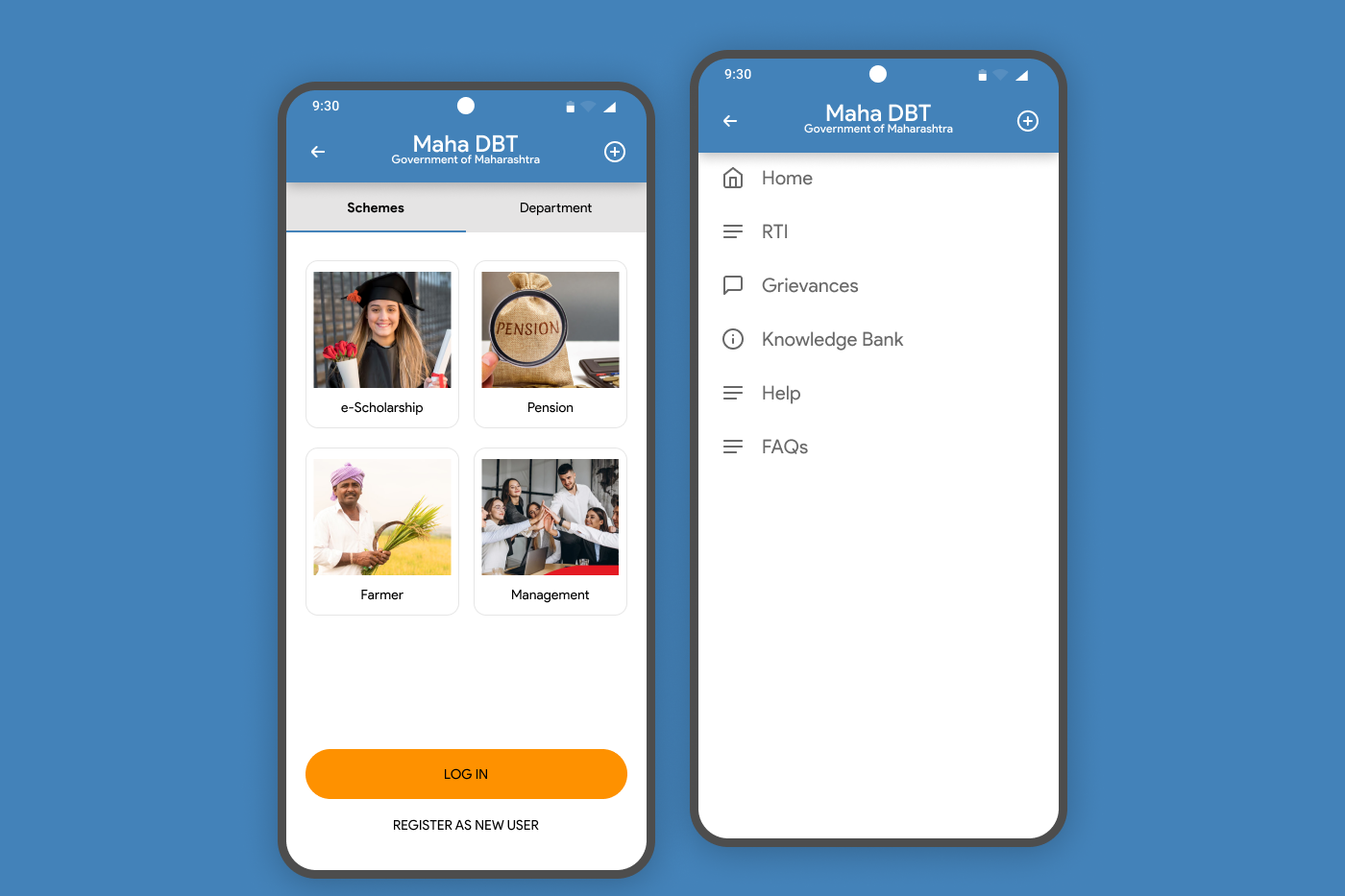

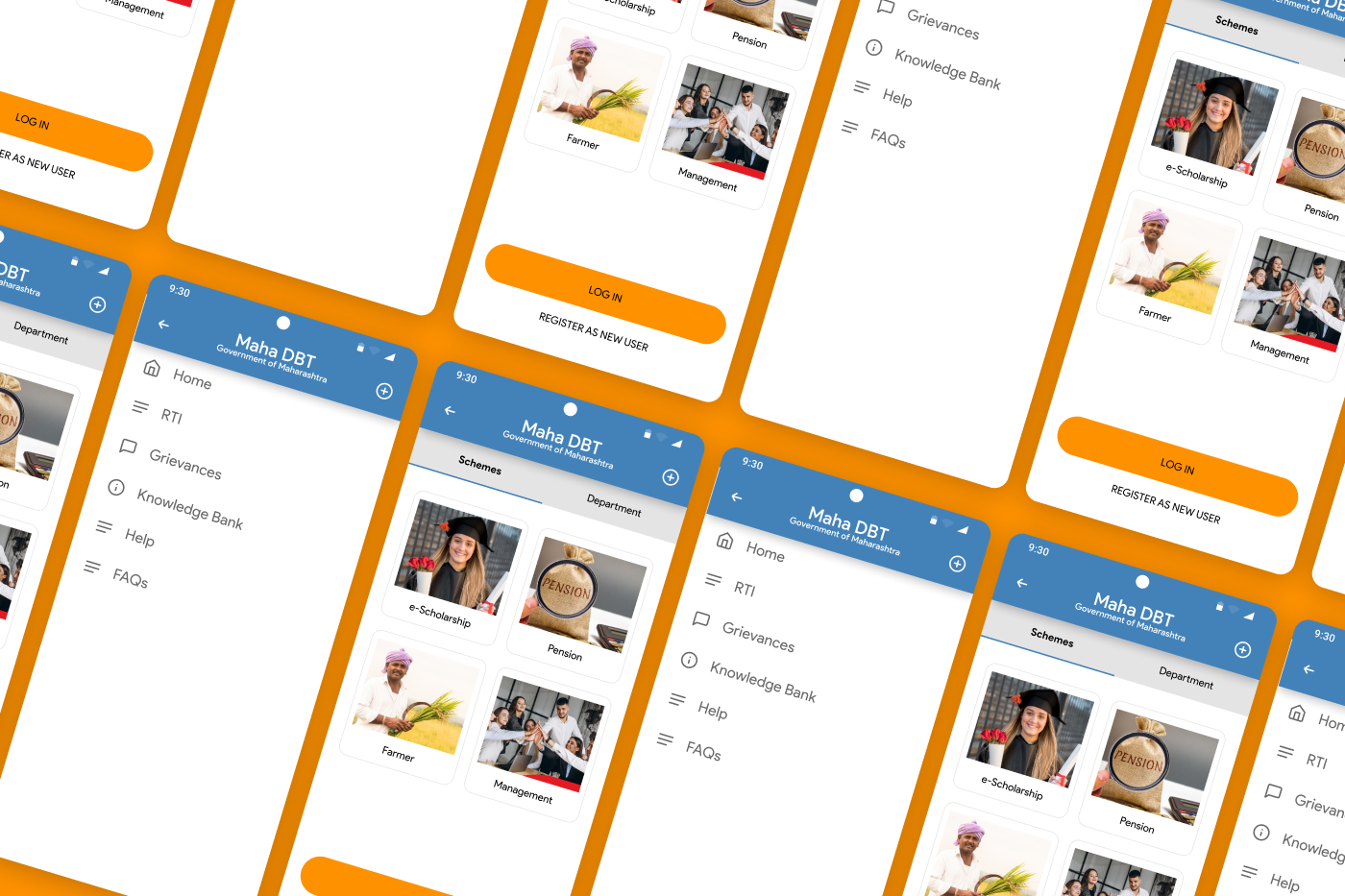

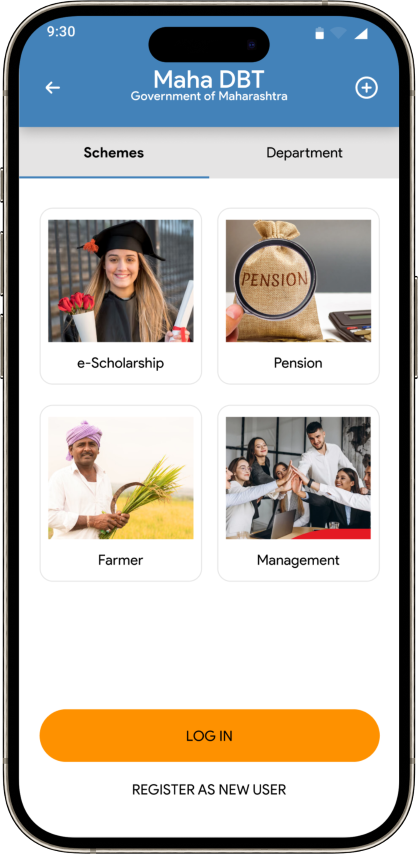

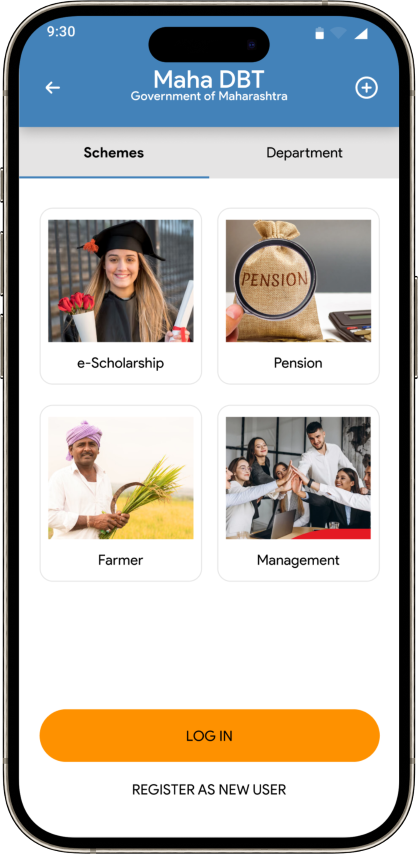

MAHA

DBT

The Maharashtra Govt Loan Settlement Application streamlines loan

resolution processes, enhancing efficiency and transparency for borrowers and administrators

through a user-friendly digital platform, ensuring swift and accurate settlements.